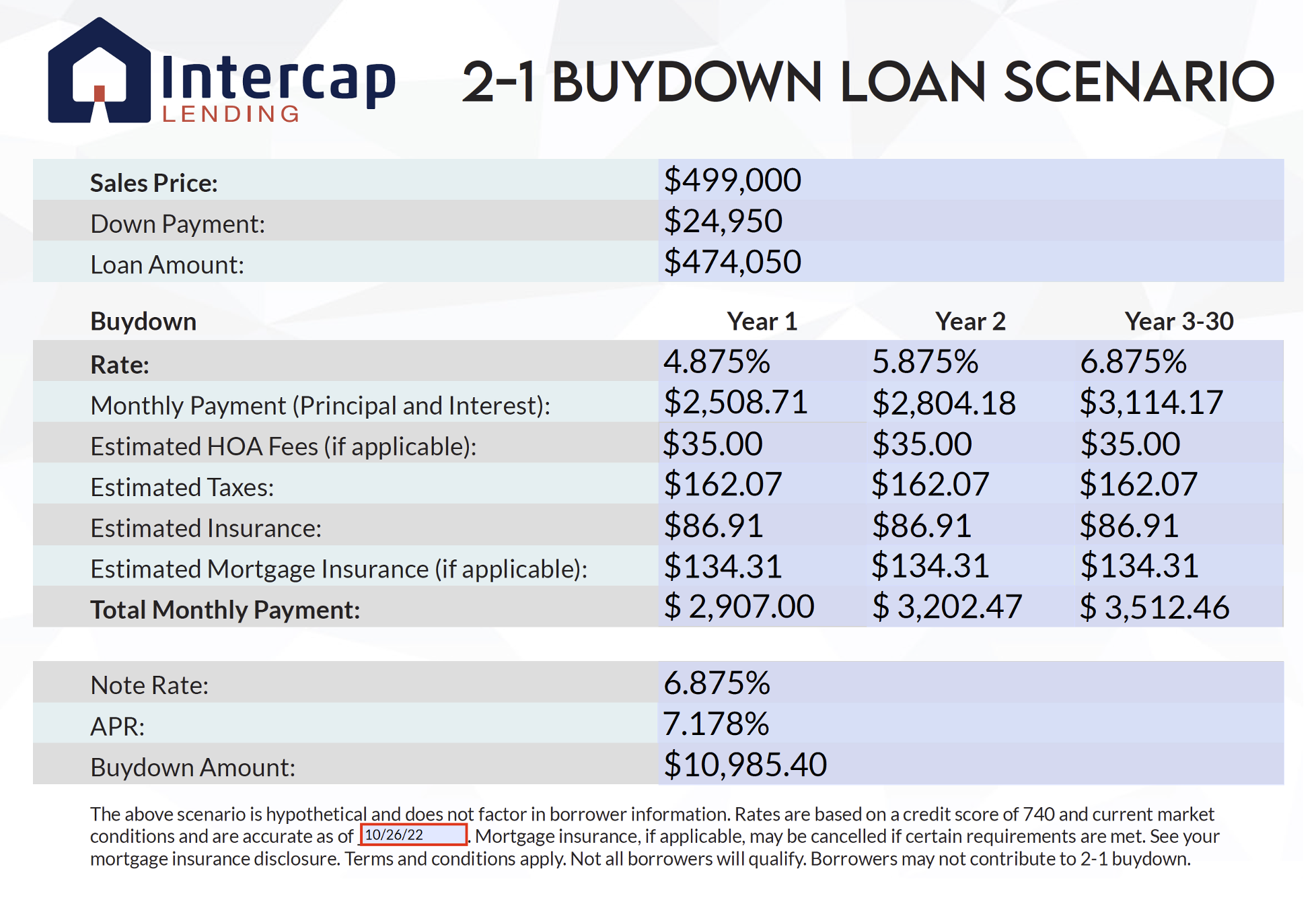

18+ buy down mortgage

Web Buying down a mortgage involves someone paying the lender an amount of money in exchange for a reduced interest rate during the first years of a mortgage often. Web Buying down a mortgage involves someone paying the lender an amount of money in exchange for a reduced interest rate during the first years of a mortgage.

Mortgage Introducer July 2022 By Key Media Issuu

Web What is a mortgage buydown.

. For example if a buyer chooses to buy down the mortgage. Results are hypothetical and may not be accurate. Web On a 200000 loan purchasing one point brings the mortgage rate from 41 to 385 dropping the monthly payment from 957 to 938 a monthly saving of.

While the stock has lost 132. That means if you purchased a home two years ago with a 30-year mortgage. This is not a.

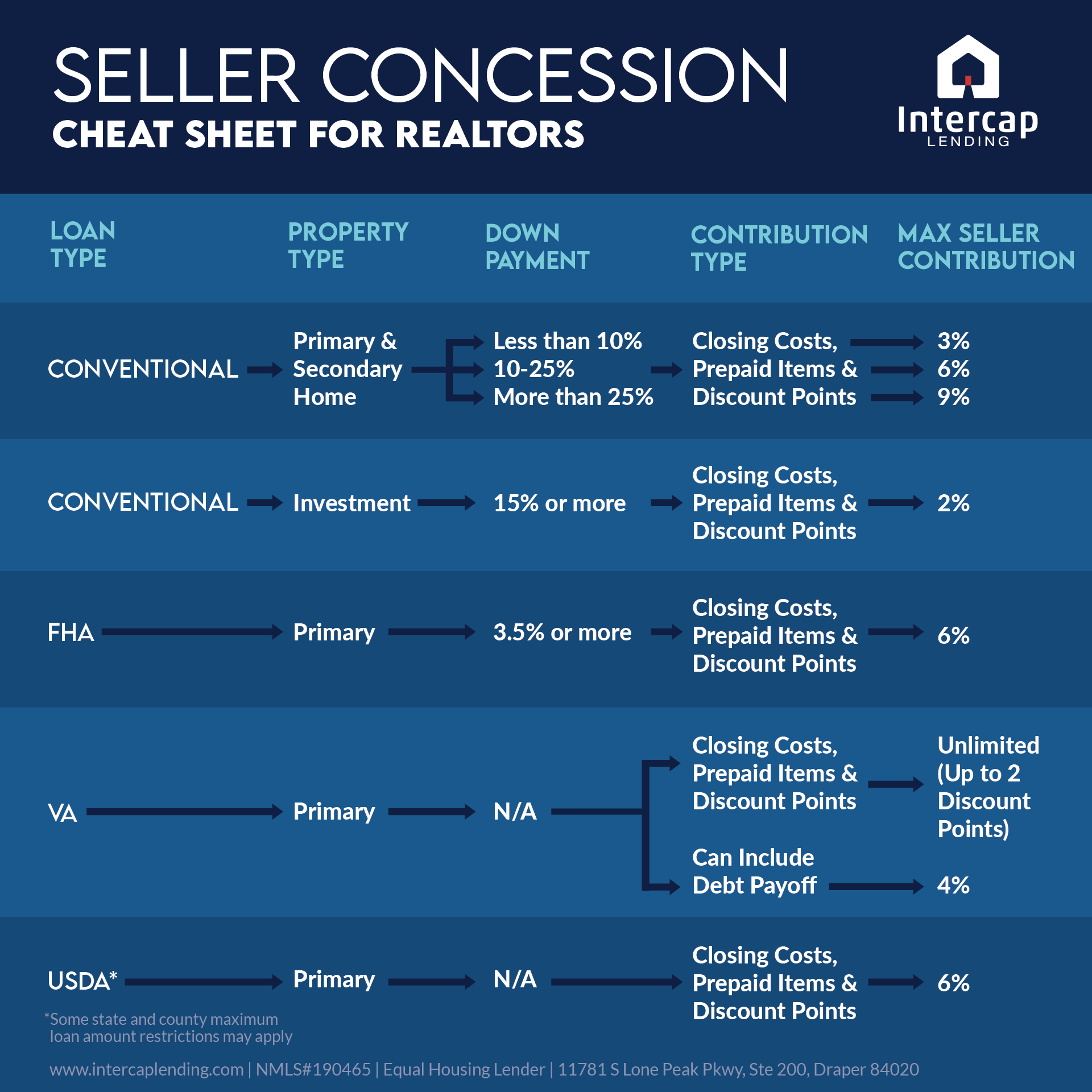

Web Today the average interest rate is 706 with average home prices up to 525000. Any Mortgage Loan in respect of which pursuant to a Buy-Down Agreement the monthly interest payments made by the related Mortgagor. Web Total buy down fee for this loan is 11464 5000 is paid by a third-party and 6464 is paid by you.

Web Define Buy-Down Mortgage Loan. Web The average buy-to-let mortgage rate is currently 595 per cent up from 29 per cent a year ago according to Moneyfacts. For example you might pay one point upfront for an interest rate that is 375 lower for the entire 30.

View All Loan Programs. Invesco Mortgage Capital IVR has been beaten down lately with too much selling pressure. A mortgage point typically costs around 1 of.

Web You can do a buydown by purchasing mortgage points sometimes called discount points on your loan at closing. Web Anyone between the ages of 18 and 40 can open a Lifetime Isa to save up for buying a first home. Web A 2-1 buydown is a type of financing that lowers the interest rate on a mortgage for the first two years before it rises to the regular permanent rate.

Web With a 1-0 buydown the mortgage rate and monthly payments are lower for the first year of the loan rising for the second year of the loan and onward. This means the typical landlord fixing a. A mortgage rate buydown which is often called a buydown mortgage for short is a financing arrangement that gives a borrower.

The seller is required to contribute to your loan to lower the. Web A Temporary Buydown reduces your interest rate on your mortgage for the first year or two of your loan. Web thelampmanhometeam Original audio.

Web In a 3-2-1 buydown your interest rate will be 3 lower the first year 2 lower the second year and 1 lower the third year before adjusting to your fixed rate. Web The total buydown cost will be higher than buying down the mortgage for the first two or three years. Web This is known as buying down your rate on a permanent basis.

Web 218 005 Dow 30. The cash can be used after an initial 12 months and the. Low Money Down Loans.

Mortgage Rate Buydowns Are Back Bankrate

Mortgage Rate Buydown Intercap Lending

Home Loans Yokine Dianella Morley Mortgage Choice

Mortgages Listerhill Credit Union

Mortgage Rate Buydown Intercap Lending

Fha Mortgage Rates Best Fha Home Loan Rates Programs

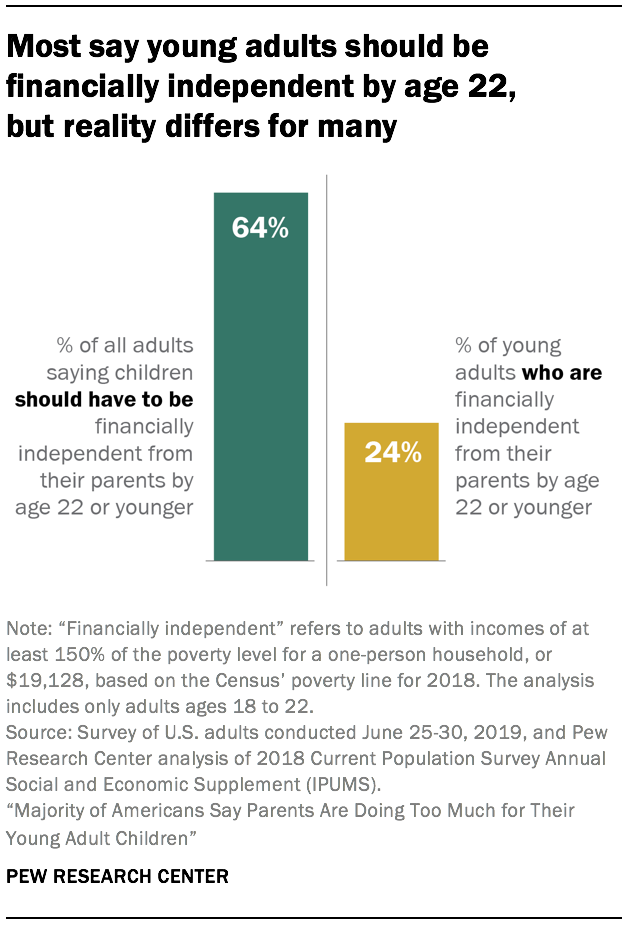

Most Americans Say Parents Do Too Much For Their Young Adult Children Pew Research Center

What Is A Buydown Interest Rate Moneytips

What Is A 3 2 1 Buydown Mortgage Nfm Lendingnfm Lending

Home Sefcu

Temporary Subsidy Buydown Mortgages Marimark Mortgage

Interest Only Mortgages Mortgage Guides Tsb Bank

E320dclavc8zhm

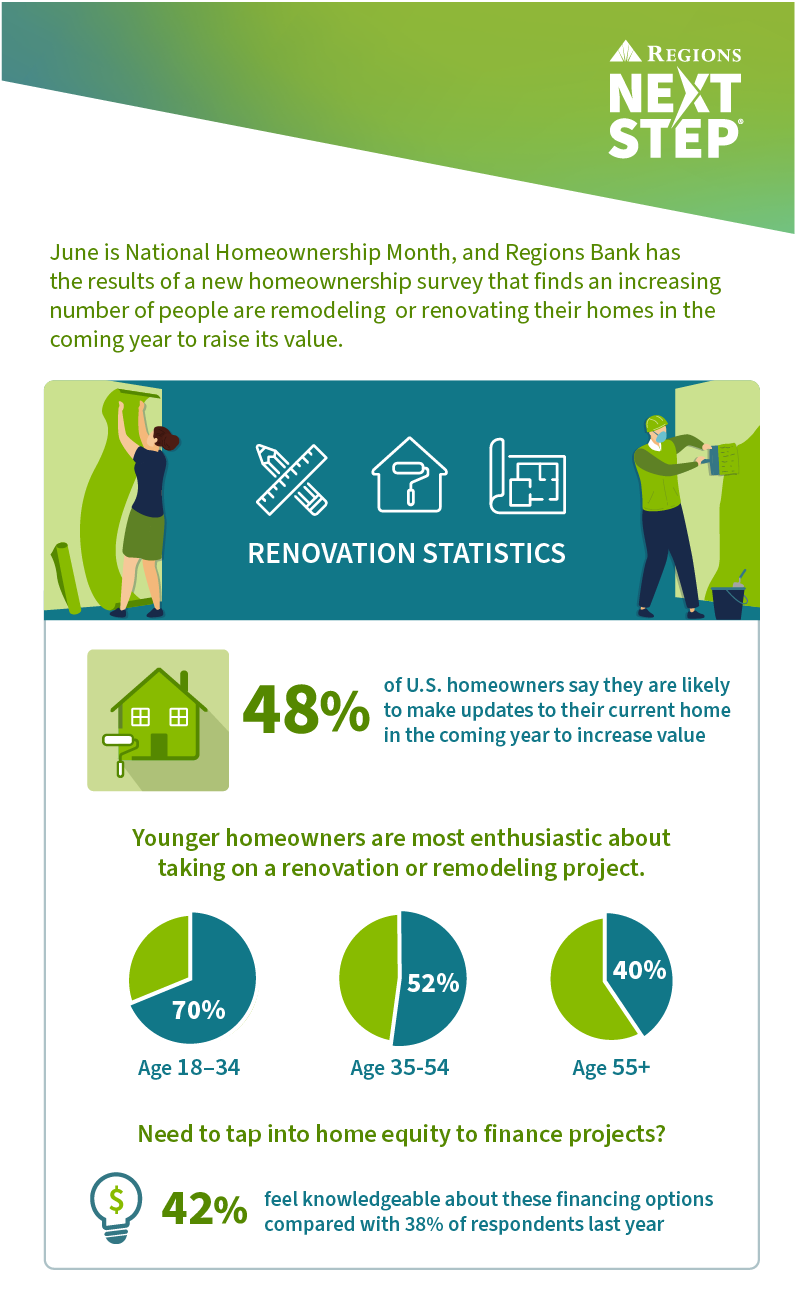

Csrwire Regions Next Step Survey Finds Americans Are Increasingly Prioritizing Renovations To Boost Home Value

Virgin Money Mortgages Mortgages Virgin Money Uk

Buydown A Way To Reduce Interest Rates Rocket Mortgage

Mortgage Rate Buydown Intercap Lending